We'll Install The Perfect Lead Gen System Into Your Business...

...So that you don’t need to worry where your next qualified lead is going to come from for the rest of your business life!

Speak to us about our single fee setup, no retainer offer!

Financial Services

Business to Business (B2B)

Software as a Service (SaaS)

A Lead Generation System Where Your Ideal Customers Hang Out!

Cold Email

We'll build an automated email outreach system that will get you in front of 10k+ ideal customers every single month.

Facebook Ads

We’ll help you harness the potential of Facebook ads to generate new, highly qualified leads.

LinkedIn Ads & Outreach

We’ll help you leverage the power of LinkedIn ads to generate new, highly qualified leads and create valuable connections.

Meet Hitesh!

We'll build an automated email outreach system that will get you in front of 10k+ ideal customers every single month.

I've been fortunate to work with companies all around the world across Financial Services, B2B and SaaS generating thousands of leads, appointments and demos, helping clients grow their revenue.

Got a question about lead gen?

Book a call below or connect with me directly on LinkedIn.

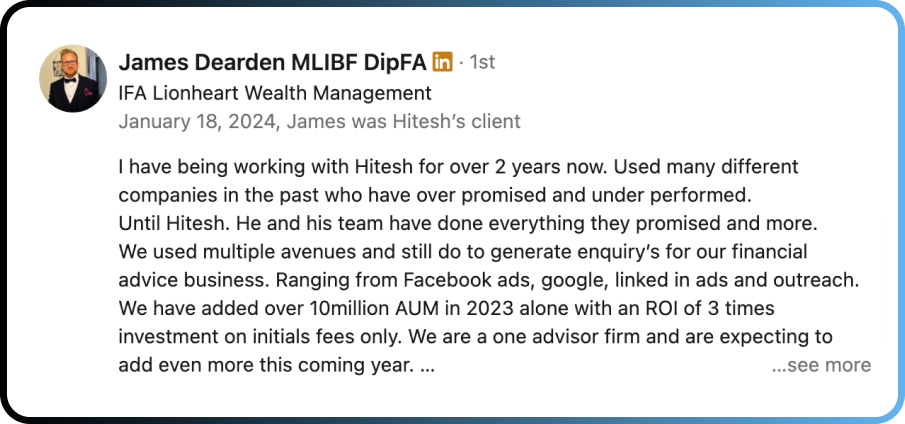

What They Say About Us

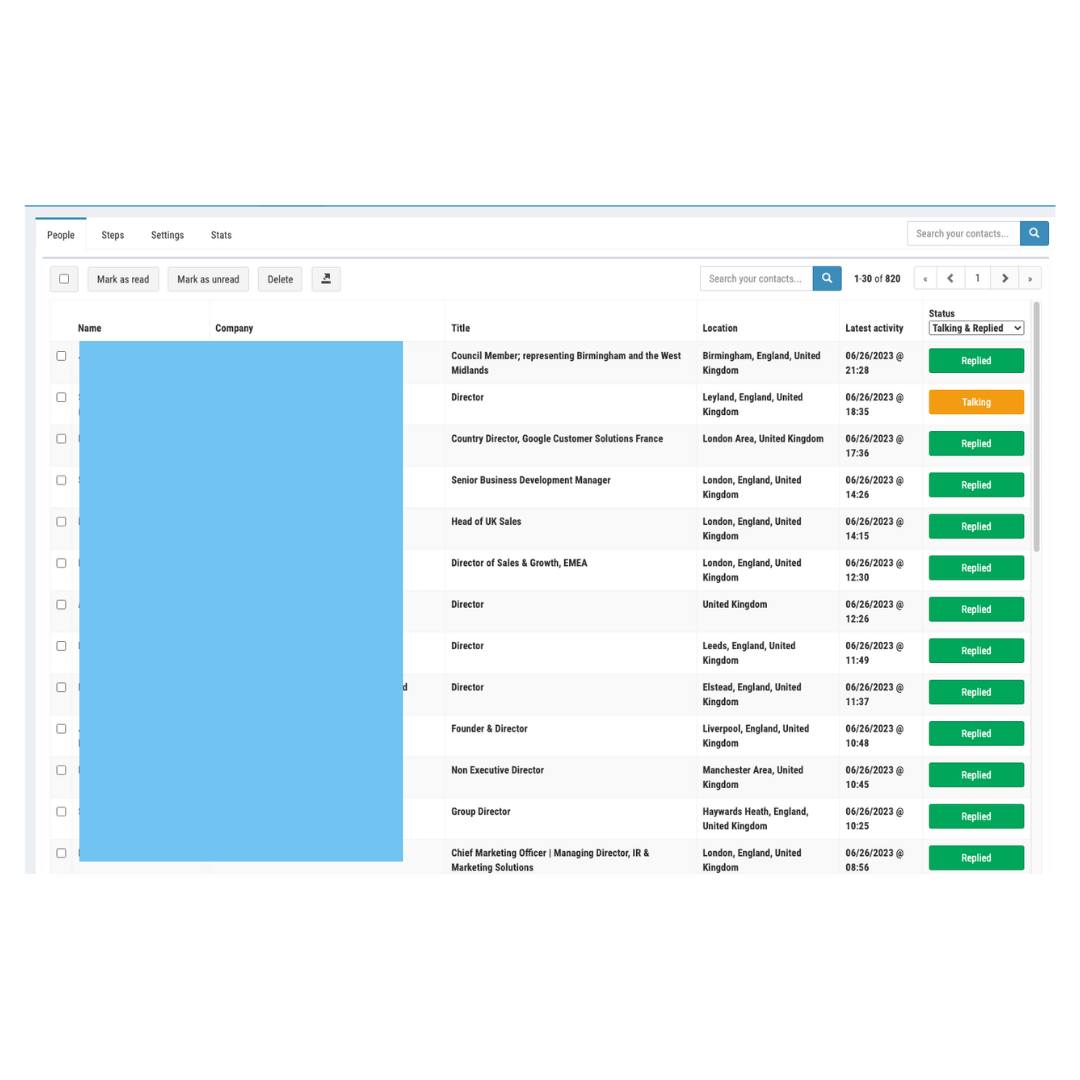

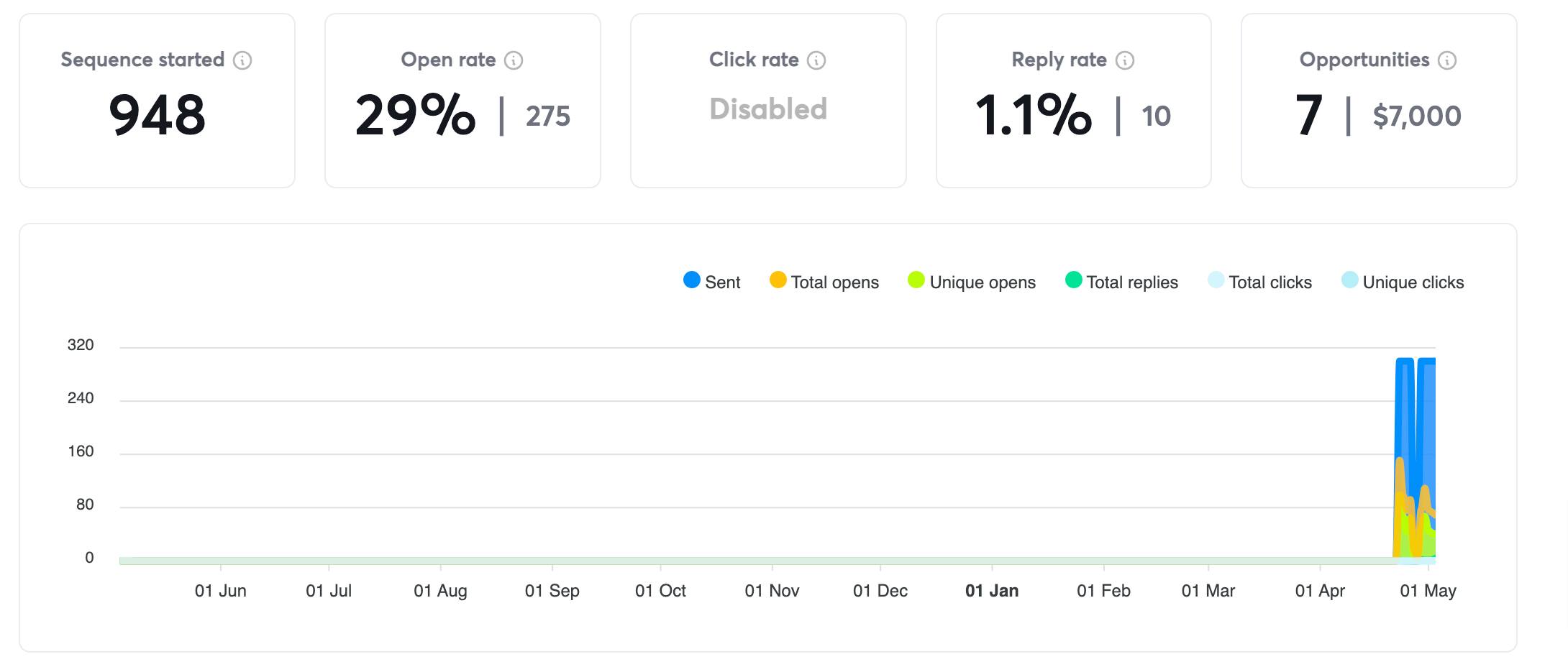

Recent Lead Generation System Results

Some example results from our Cold Email, Facebook, LinkedIn Ads & Outreach campaigns.

Our Latest Lead Gen Insights

Building Trust Online: Strategies for Financial Advisors in the Digital Era

In the financial services industry, trust is the cornerstone of every client relationship. Financial advisors are entrusted with sensitive information and significant financial decisions, making it essential to establish and maintain trust. In today’s digital era, where face-to-face interactions are often limited, building trust online has become more critical—and challenging—than ever before.

Financial advisors must not only adapt to new digital platforms but also find ways to translate the personal trust they establish in-person to the online world. This blog will explore key strategies for building trust online as a financial advisor, ensuring you can create long-lasting relationships with clients, even in a virtual environment.

1. Develop a Professional and User-Friendly Website

Your website is often the first point of contact for potential clients, and first impressions matter. A well-designed, professional website reflects your credibility and instil confidence in visitors.

Key Elements of a Trustworthy Website:

Clear Branding: Ensure your website clearly reflects your brand, including your logo, company name, and consistent colour scheme. This creates a sense of professionalism and reliability.

Easy Navigation: A user-friendly layout with intuitive navigation helps clients find the information they need quickly. Ensure that essential sections like services, about us, and contact details are easy to access.

Professional Design: Your website should look polished and modern, free of clutter or outdated designs. Avoid using too many flashy elements or pop-ups that could frustrate users.

SSL Certification: A secure website with an SSL certificate (HTTPS) is non-negotiable. It ensures the safety of client data and signals to users that your site is secure.

A well-crafted website builds credibility, helping clients feel more comfortable interacting with your business from the outset.

2. Create Valuable and Educational Content

Building trust online means proving your expertise, and one of the best ways to do this is through high-quality content. Providing valuable, informative content not only educates your audience but also positions you as a thought leader in the financial services space.

Types of Content That Build Trust:

Blog Posts: Regularly publish blog posts on relevant financial topics, such as investment strategies, retirement planning, or market updates. This shows your knowledge and keeps clients informed.

White Papers or Guides: Offer in-depth resources like white papers or financial guides that provide comprehensive advice. For example, a guide on tax-efficient investing can demonstrate your expertise in a specialised area.

Webinars or Videos: Hosting webinars or posting educational videos allows you to engage with your audience on a more personal level. These formats help clients put a face to the name and give them a sense of your communication style.

Case Studies or Client Success Stories: Share case studies that highlight how you’ve helped clients achieve their financial goals. Real-world examples help establish credibility and demonstrate the tangible impact of your services.

By consistently delivering valuable content, you reinforce your position as a knowledgeable and trustworthy advisor.

3. Leverage Client Testimonials and Reviews

Word of mouth has always been a powerful tool in the financial services industry, and in the digital era, online reviews and testimonials play a crucial role in establishing trust. Prospective clients are more likely to trust the experiences of others before committing to working with a financial advisor.

How to Use Testimonials Effectively:

Feature Testimonials on Your Website: Include a dedicated testimonials page or showcase client feedback on your homepage. Video testimonials can be especially powerful, as they add a personal touch and authenticity.

Highlight Specific Results: Where possible, focus on client results or successes. For example, a testimonial that highlights how you helped a client improve their retirement strategy or navigate a market downturn is particularly impactful.

Use Google Reviews or Trustpilot: Encourage satisfied clients to leave reviews on platforms like Google or Trustpilot. A strong portfolio of positive reviews can significantly boost your online reputation and attract new clients.

Client testimonials and reviews are social proof that you can deliver results and provide a reliable service.

4. Be Transparent and Authentic

In an industry like financial services, transparency is essential. Clients want to know that they are working with someone who will be open and honest about both the risks and rewards of financial planning.

Ways to Foster Transparency:

Clarify Your Fees: Be upfront about your fees and any additional costs clients may incur. Whether you charge a flat fee, percentage-based fee, or commission, make sure this information is clearly explained on your website and in client communications.

Set Realistic Expectations: Be honest about potential outcomes. While it’s tempting to promise great returns or swift financial success, clients appreciate advisors who are realistic and manage expectations.

Open Communication Channels: Make yourself accessible to clients. Whether through email, video calls, or instant messaging platforms, clients should feel they can reach out to you with any concerns or questions. Responding promptly and openly builds confidence in your professionalism.

Being transparent fosters trust and reassures clients that they are not being misled or kept in the dark about important financial matters.

5. Utilise Social Media to Build Relationships

Social media is a powerful platform for financial advisors to engage with current and prospective clients in a more informal setting. It allows you to showcase your personality, share insights, and interact directly with your audience.

Best Practices for Using Social Media to Build Trust:

Share Informative Content: Regularly post financial tips, market updates, and educational resources that demonstrate your expertise. By sharing useful content, you position yourself as a reliable source of information.

Engage with Followers: Respond to comments, answer questions, and interact with your followers. Engaging with your audience shows that you’re approachable and open to communication.

Maintain a Professional Tone: While it’s important to be personable, remember that you are representing a professional service. Ensure that your tone remains respectful and professional at all times, even on more casual platforms like Facebook or Twitter.

Showcase Client Successes (With Permission): Sharing case studies, client success stories, or milestone achievements (with client consent) can reinforce your credibility and demonstrate the impact of your services.

Social media is not just about promoting your services—it’s about building relationships and establishing yourself as a trusted advisor within your community.

6. Maintain a Strong Online Presence with Consistent Updates

Consistency is key when building trust online. Clients want to know that they can rely on you to be present, active, and engaged over time. An out-of-date website or an inactive social media account can quickly undermine trust.

How to Maintain Consistency:

Regular Website Updates: Keep your website fresh with up-to-date information about your services, team members, and any new developments in the financial world. A regularly updated blog or news section shows that you’re active and current.

Social Media Activity: Post regularly on social media and respond to messages or comments in a timely manner. Inconsistent activity can make your firm appear inactive or uninterested in client engagement.

Email Newsletters: Send out regular email newsletters with updates, insights, and personalised advice for your clients. This keeps you top of mind and ensures that clients feel connected, even if they don’t interact with you frequently.

By maintaining a consistent online presence, you reassure clients that you are committed to being a reliable and accessible financial advisor.

7. Secure Your Online Platforms

Finally, ensuring the security of your online platforms is a critical factor in building trust. Financial information is sensitive, and clients need to know that their data is protected when they interact with you online.

Key Security Measures to Implement:

Data Encryption: Ensure that any personal or financial information shared online is encrypted to prevent unauthorised access.

Secure Payment Platforms: If you offer online payment options, ensure they are secure and compliant with financial regulations.

Regular Security Audits: Regularly audit your website and online platforms to identify and address any potential security vulnerabilities.

Two-Factor Authentication: Offer clients two-factor authentication for accessing any online accounts or services. This adds an extra layer of protection against unauthorised access.

Security is a fundamental aspect of trust-building in the digital age, and safeguarding client information is critical to maintaining that trust.

Conclusion

Building trust online is no longer optional for financial advisors—it’s a necessity in today’s digital-first world. By developing a professional online presence, creating valuable content, leveraging client testimonials, and maintaining transparency, you can foster trust with both current and prospective clients.

Additionally, being active on social media, maintaining consistency across all platforms, and ensuring the security of client information are key components of building long-lasting, trustworthy relationships in the digital age.

By implementing these strategies, you can confidently navigate the online landscape and strengthen your role as a trusted financial advisor.

Access our free training on how to set up a cold email system that sends 20k+ emails per month for less then $500, booking in 3-5 appointments/demos per day.

Click here to find out more - https://leadgenagency.co/freetraining